Polymarket Israel Iran Heats Up

Tensions between Israel and Iran have returned to the global stage, and as always, Polymarket traders are ready to respond, this time with bold moves and high stakes. What began as just another geopolitical market has rapidly evolved into a high volatility event, driven by a combination of early speculation and escalating international pressure.

First the Trades, Then the News: A Suspicious Sequence

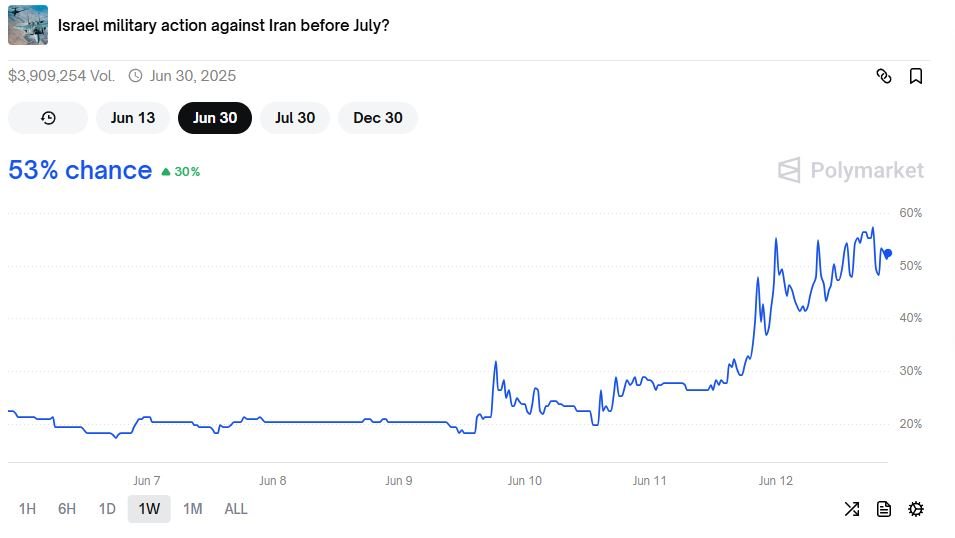

Initially, the market “Will Israel take military action against Iran before July?” was quiet and heavily skewed toward “No,” with pricing at around 80% NO vs. 20% YES. But then something strange happened.

Large, aggressive purchases began to hit the market, coming from new, anonymous accounts with no prior history on Polymarket. These wallets opened in June 2025 and began deploying $50,000 to $100,000 at a time all concentrated in a few specific markets about potential Israeli strikes

At the time, many traders wondered:

“Do they know something we don’t?”

But the real twist came after those purchases.

Real-World Tensions Begin to Match the Market

Several days later, the geopolitical landscape started to catch up. The international press began reporting:

- Breakdowns in nuclear negotiations with Iran

- Israeli officials making direct threats regarding Tehran’s capabilities

- The U.S. ordering the withdrawal of non-essential diplomatic staff from Iraq, citing regional risk escalation

As these headlines emerged, the market reacted. On June 12, the price of “YES” in the main market surged to 53%, as traders reevaluated the probability of a real strike.

At this point, what initially looked like suspicious trading activity now seemed prescient and even more alarming.

The day of the attack

While most headlines suggested that any Israeli action would likely come later in June, Polymarket told a different story. On June 13, a sudden and coordinated wave of large YES side buys hit this market, coming from anonymous accounts focused exclusively on the conflict markets.

For attentive traders, these moves raised alarms. The volume, timing, and wallet behavior didn’t align with the public narrative.

“Why buy that aggressively if the consensus is that a strike is weeks away?”

Then came the twist just hours later, the news broke:

Israel had launched a military strike against Iran 🙂

As confirmed by the final chart of the market “Israel military action against Iran by Friday?”, the probability spiked from under 20% to 100% within a single day. The market resolved YES, confirming that the action not only occurred, but happened precisely within the time window being speculated on-chain.

For many traders holding “NO” positions based on timing and perceived caution, the blow was immediate.

Confidence collapsed, and a sense of predictability vanished with it.

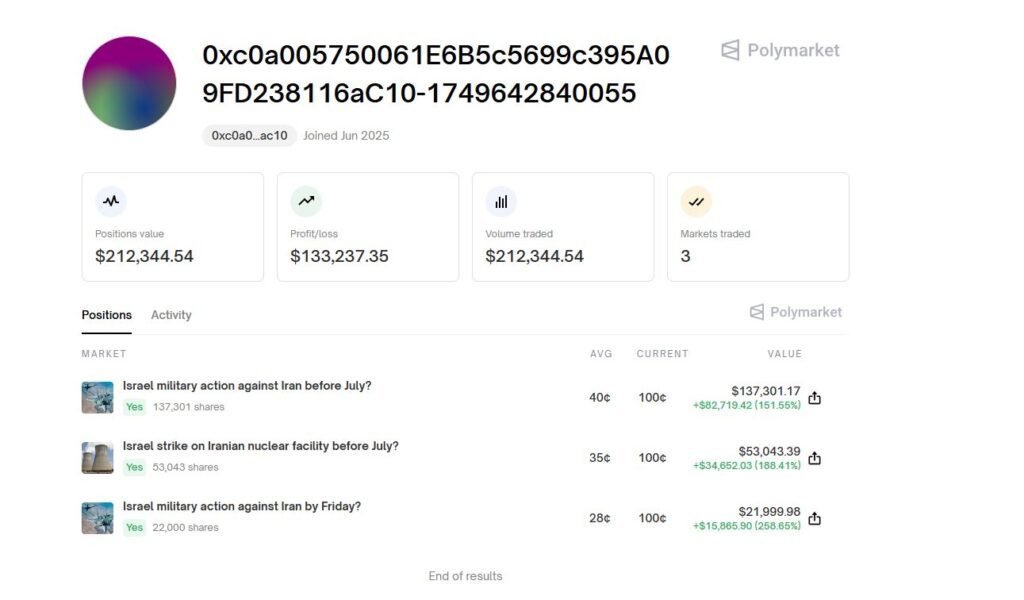

One Wallet, Three Markets, Massive Bets

One trader in particular has drawn attention (see image). This wallet:

- Joined in June 2025

- Has traded only three markets, all related to Israel-Iran conflict

- Is he a PRO?!

This kind of concentrated and confident activity has stirred talk of insider knowledge or highly informed positioning. Some call it smart money. Others call it suspicious.

Key Tips for Traders in these situations

Trading political conflict is not like trading election data or economic indicators. These markets are emotionally charged, event driven, and prone to sudden shocks. Here’s how to operate wisely:

- Verify news through multiple, trusted sources

Avoid reacting to viral headlines or unverified social media claims. Use reputable international outlets and cross-check reports. - Use official sources when available

Look for updates directly from government agencies, military statements, or diplomatic releases. - Monitor on chain activity and wallet behavior

In situations like this, large coordinated trades from new accounts might signal shifts in market sentiment or knowledge. Watch how and when they enter. - Follow local sources and regional reporters

Local journalists often break developments before global media catches up. Use platforms like X (Twitter), Telegram, or even languagespecific news website even strange ones. - Stay objective and plan exits

Don’t get emotionally locked into a position. Volatility cuts both ways plan for both outcomes and avoid overexposure.

All Eyes on the Next Move: Will Iran Respond?

Now that the Israeli strike has happened, attention has shifted to a new market already live on Polymarket:

“Will Iran retaliate against Israel before July?”

Tensions remain high, and traders are once again scanning wallets and news feeds, asking themselves:

Will the same insider wallets reappear? Or was it all just coincidence?

Some users even joke that Iran itself might be hedging via Polymarket covering risk for a potential strike by betting against itself.

Serious or not, the speculation reflects one thing clearly:

Polymarket has become a digital mirror of global crisis. Where others report on events, here they are traded live, second by second

Final Thoughts on: Polymarket Israel Iran

The Israel-Iran markets on Polymarket represent one of the most intense trading environments of 2025. With a mix of speculation, timing, and global risk, every trade is a calculated bet on more than just price it’s a read on the world itself.

Stay alert, stay informed, and above all, trade with clarity 🙂

However this story ends, it will be remembered for a long time by those who took part in this market, but let’s hope for a good ending

-

The First US Shutdown of 2026 on Polymarket?

Less than four months ago, Polymarket traders were busy forecasting the end of one of the…

-

Portugal Presidential Election 2026 on Polymarket

On the western edge of Europe, on the Iberian Peninsula, Portugal is preparing for a highly…

-

The US-Venezuela crisis on Polymarket

In the Caribbean Sea, for months now, Polymarket traders have been grappling with a scenario as…