polymarket zelenskyy suit market

Few markets outside of major U.S. elections can claim over $55 million in trading volume, but the seemingly lighthearted question “Will Zelenskyy wear a suit before July?” has become one of the most controversial and discussed markets in Polymarket history and a case study in how UMA resolutions work.

What started as a niche cultural bet has evolved into a complex dispute with implications for trader trust, protocol logic, and the nature of prediction markets themselves.

The Background:More Than Just a Jacket ?

To understand the full story, we need to go back. Over the past year, Ukrainian President Volodymyr Zelenskyy has appeared in various outfits that resemble Western-style suits

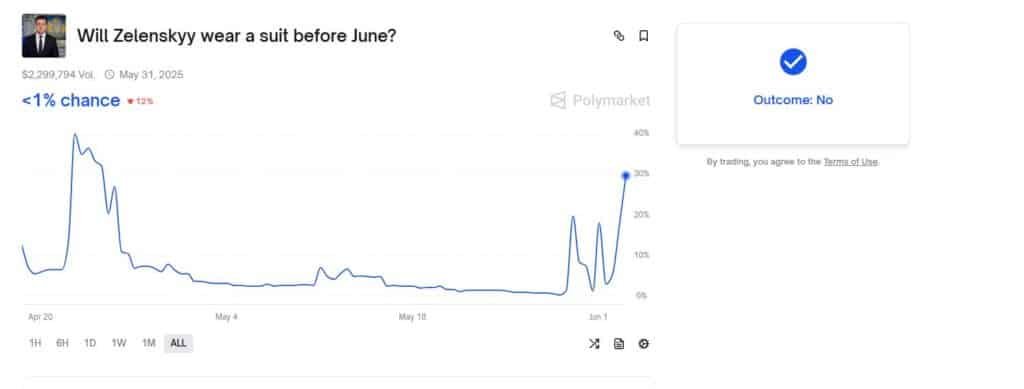

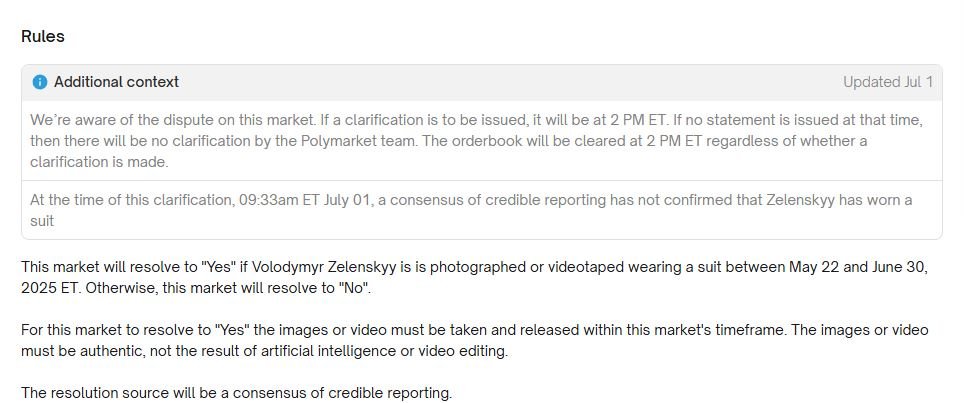

Earlier, in the market “Will Zelenskyy wear a suit before June?”, several YES proposals were rejected by UMA, with voters citing the fact that Zelenskyy himself had previously stated he would only wear a formal suit at the end of the war, others referred to the fact that not many articles reported such news, or that it was actually not a suit for them.

As a result, UMA established a precedent, which became a key factor for future markets. On UMA, past decisions matter. They shape future votes, especially in subjective or recurring market themes.

The NATO Meeting: A Turning Point

On June 25, Zelenskyy attended a high-level NATO summit wearing an outfit that appeared slightly more formal than usual. YES traders rushed in, confident this was the moment they’d been waiting for.

The market was sent to UMA, where the first verdict came in: P4 (Too Early) meaning it was too soon to resolve. As more YES proposals were submitted, they were repeatedly challenged and rejected, and the deadline approached.

At that point, only two outcomes were possible: YES or NO.

Veteran Traders Take Position

As the deadline neared, experienced Polymarket traders began making major moves. One of the most prominent was Erasmus, also known as “the bond terrorist”, who treated the market as a guaranteed NO

After Polymarket issued an official clarification, stating that Zelenskyy had still not worn a Western style suit, the case for YES weakened further.

For many, that statement closed the door on the dispute and the market started trading like a bond, with high confidence in NO.

How UMA Decides: Spirit vs. Rules

UMA resolutions(here a guide about UMA) are often based on two key frameworks:

- The Spirit of the Market

What did traders truly believe the market was about? What outcome were they betting on? This includes community understanding, context, and intent not just literal wording. - The Rules of the Market

This refers to the strict market title, description, and resolution criteria. If a proposal matches the rules but violates community expectations, it may still be rejected.

UMA voters weigh both. This is what makes the system flexible but also unpredictable and mastering both perspectives is critical for trading in high-stakes, ambiguous markets.

In the Zelenskyy suit market, these logics collided. YES traders argued based on appearance and news report, while NO traders pointed to intent, precedent, and clarity. UMA ultimately leaned toward consistency.

Possible Scenarios During a UMA Vote

UMA voting can take unexpected turns. Here are some typical outcomes:

- Evenly split sentiment: The community remains divided, creating high volatility and uncertainty.

- Another Clarification from Polymarket?: Rare, but influential. An official message can sway sentiment dramatically.

- Market becomes a bond: Traders start treating the vote as a formality, expecting a YES or NO result based on precedent.

- Shock reversal: Occasionally, a market that looks 90% settled flips due to a surprising vote, sending it from YES to NO (or vice versa) within minutes.

These dynamics make UMA disputes some of the most difficult and dangerous markets to trade.

What Traders Get Wrong And What to Learn

Markets like this are attractive because of the potential payout. YES often offers massive upside during disputes. But as seen here, many traders jump in without understanding UMA, its voting structure, or the precedent system.

In disputed markets, knowledge beats emotion. And knowing UMA’s logic including its key voters and voting behavior can mean the difference between a major win and a complete loss.

Polynoob’s Mission

This article is part of Polynoob’s ongoing effort to make predictive trading more transparent, accessible, and survivable.

We want every trader, from first timers to veterans, to understand not just the market but the system behind it. Because long term success on Polymarket doesn’t just come from betting right it comes from learning how these markets truly work

Disclaimer:

This article is for informational purposes only. It is not intended to discredit UMA, its governance system, or its participants. The goal is to help Polymarket users better understand how disputes and voting processes work.

-

The First US Shutdown of 2026 on Polymarket?

Less than four months ago, Polymarket traders were busy forecasting the end of one of the…

-

Portugal Presidential Election 2026 on Polymarket

On the western edge of Europe, on the Iberian Peninsula, Portugal is preparing for a highly…

-

The US-Venezuela crisis on Polymarket

In the Caribbean Sea, for months now, Polymarket traders have been grappling with a scenario as…