The First us Shutdown of 2026 on Polymarket?

Less than four months ago, Polymarket traders were busy forecasting the end of one of the longest U.S. government shutdowns in recent history. Now, in the first month of 2026, the shadow of another shutdown is once again over Washington

History is repeating itself faster than many expected 🙂

What Triggered the New Shutdown Risk

The current crisis began with reports that key funding packages for the U.S. government would not be approved, specifically those related to security and immigration departments, unless lawmakers agreed to remove or significantly loosen operational limitations placed on them.

This immediately raised alarm bells across markets. Funding disagreements tied to border policy and national security have repeatedly proven to be some of the most difficult issues to resolve in Congress, often stalling negotiations until the last possible moment.

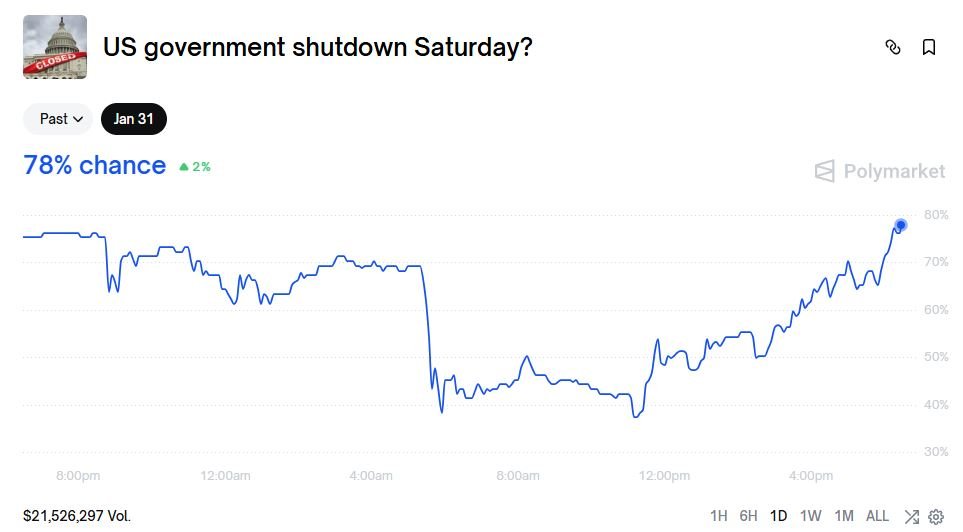

According to multiple congressional sources and early reporting from Capitol Hill, talks initially stalled, pushing shutdown probabilities sharply higher on Polymarket.

Markets Cool as Deal Rumors Emerge ?

More recently, news of a potential compromise agreement has begun to circulate. As a result, the probability of a shutdown has dropped significantly compared to earlier in the week.

That said, timing is everything.

To officially avoid a shutdown, the funding deal must be finalized and signed before midnight on Saturday, January 31. This makes Thursday and Friday absolutely critical, as any delay could quickly reignite market volatility.

Past precedent shows that even when deals exist in principle, signatures do not always come in time.

Whale Positions and Market Psychology

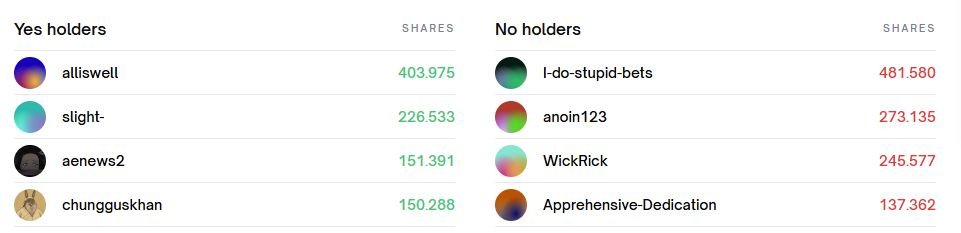

Several well known Polymarket veterans remain positioned for a shutdown scenario. Accounts such as aenews, with positions exceeding 150,000 dollars, and chungguskhan, also near 150,000, continue to reflect lingering skepticism about Congress reaching the finish line.

However, it is entirely possible that these whales are holding dry powder, waiting to reposition late, as has happened in previous funding crises.

On the other side, new accounts are making waves. One notable example is “I-do-stupid-bets”, holding positions worth over 400,000 dollars. Traders are watching closely to see whether the username proves ironic or prophetic.

Key Market to Watch

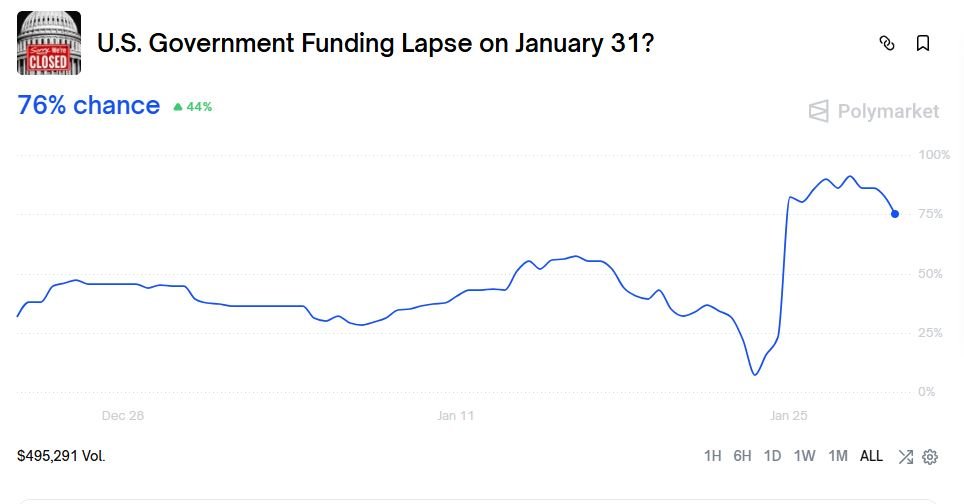

One of the most important marekts right now is also

U.S. Government Funding Lapse on January 31?

Technically, to prevent an official shutdown, the president must sign the funding bill before midnight on January 31. In past cases, including under Biden, signatures have sometimes come late or after brief lapses. Under Trump, however, an unexpected last minute signature is always a real possibility, so stay safe

This uncertainty keeps the market alive even as probabilities fluctuate

Some Trading Tips for Shutdown Markets

Shutdown markets are driven by timing, information asymmetry, and last minute political signaling. So here some tips by Polynoob

- Monitor political sentiment on X

Statements from lawmakers, party leadership, and committee chairs often signal progress or breakdowns hours before formal announcements. Tone shifts are especially important. - Diversify across related markets

Spread exposure across multiple shutdown and funding lapse markets when possible. Even if pure arbitrage is rare, partial hedging can reduce downside risk. - Use official and primary sources

Track real legislative progress through sources like Congress.gov, committee calendars, and official congressional communications rather than relying solely on media summaries.

Conclusion about: The First us Shutdown of 2026 on Polymarket?

Another U.S. government shutdown may be avoided, but until the final signature is in place, uncertainty remains. Polymarket traders know this pattern well: optimism, rumors, late night negotiations, and sudden reversals

What will happen?

The First US Shutdown of 2026 on Polymarket?

Less than four months ago, Polymarket traders were busy forecasting the end of one of the…

Portugal Presidential Election 2026 on Polymarket

On the western edge of Europe, on the Iberian Peninsula, Portugal is preparing for a highly…

The US-Venezuela crisis on Polymarket

In the Caribbean Sea, for months now, Polymarket traders have been grappling with a scenario as…