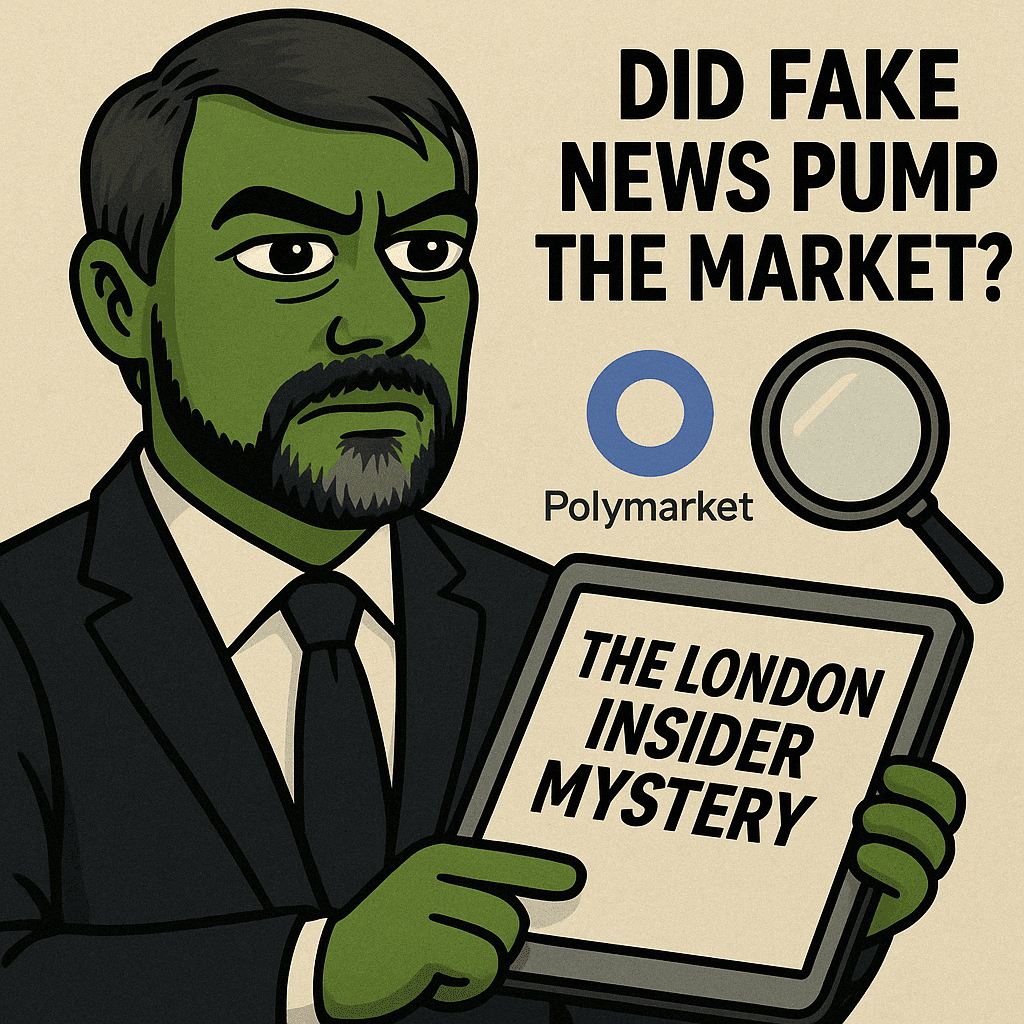

The London Insider Mystery: Did a Fake News Outlet Manipulate Polymarket?

A Sudden Emergence in Crypto Reporting

In April 2025, a relatively obscure news site, London Insider, captured the attention of the Polymarket community. The catalyst was a series of articles predicting MicroStrategy’s Bitcoin activities with uncanny accuracy and timing.

Conflicting Reports and Market Volatility

London Insider reported that MicroStrategy planned to purchase more Bitcoin between April 15 and 21, citing anonymous sources. However, within hours, the same outlet published a contradictory article stating that the purchase had been postponed until further notice. These conflicting reports caused immediate volatility in Polymarket’s market titled “Will MicroStrategy purchase Bitcoin April 15–21?”. Traders reacted swiftly, with significant positions being opened and closed in response to the news.

Questions Surround Authorship and Intent

Adding to the intrigue, the articles were attributed to “David Shepardson,” a name shared with a reputable Reuters journalist. The real Shepardson later confirmed he had no association with London Insider, suggesting the use of a false identity. This revelation raised concerns about the legitimacy of the publication and its potential motives.

A Pattern of Predictive Accuracy

Notably, prior to late March 2025, London Insider had not covered MicroStrategy. Their first article on the company, published near the end of March, accurately predicted a Bitcoin purchase announcement on March 31. Subsequent articles continued this trend of accurate predictions, leading to speculation about whether the outlet possessed insider information or was capitalizing on coincidental timing.

Accusations of Foreign Influence

Adding another layer of suspicion, London Insider has previously been accused in unrelated contexts of spreading Russian propaganda—a claim that, while unverified in this case, has only deepened public skepticism. These accusations fuel further doubts about the legality of the actions taken, the true identity of the individuals involved, and the overall transparency of the entire episode. The possibility that misinformation was deliberately injected into prediction markets for financial or political gain raises serious concerns for market integrity.

Implications for Prediction Markets

The situation underscores the susceptibility of prediction markets to external information sources, especially when liquidity is low and participant numbers are limited. A single, well-timed article—regardless of its accuracy—can significantly influence price and sentiment. This incident serves as a reminder for traders to critically evaluate information sources and remain alert to the potential for manipulation via media.

So, is London Insider run by an actual insider? Or did someone bet on Saylor’s predictable behavior and build a façade of credibility—just enough to steer the market when it counted?

The truth remains unclear. But the incident serves as a reminder that even in decentralized finance, manipulation doesn’t always come from smart contracts or exploits. Sometimes, it starts with a blog post.

For further reading, the articles in question can be found here:

- Fake UK news websites are reportedly circulating misleading stories about Western companies in Ukraine

- MicroStrategy Will Announce Latest Bitcoin Acquisition on 21 April

- MicroStrategy Postpones New Bitcoin Purchase Until ‘Further Notice’

Note: This article is for informational purposes only and does not constitute financial advice.

Index