UMA Disputes on Polymarket: How It Works, and Why It Matters

Prediction markets can offer fast trades and quick answers but when the result of a market is contested, everything slows down and the spotlight shifts to UMA, the decentralized protocol that governs market resolution on Polymarket.

Understanding how UMA works is essential for anyone serious about trading on Polymarket, especially when markets go into dispute, that can happen many times.

Proposing a Market Outcome

At the end of a market, any user can propose an outcome by clicking the “Propose” button. This requires paying a bond, which is temporarily locked to ensure that only good faith, well supported proposals are submitted.

In return, the proposer is eligible to receive a reward typically between $5 and $100 USDC, depending on the market.

Markets offer binary outcomes:

- NO

- YES

In some more complex cases, other outcomes may be discussed (like P3 or P4)

What Happens When an Outcome Is Disputed?

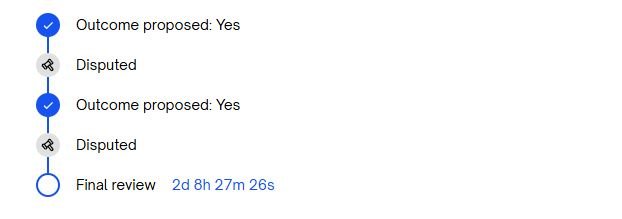

If someone disagrees with the proposed outcome, they can dispute it, triggering a formal process on UMA. As shown in the example above, a market can be disputed multiple times, with each round bringing the case back for re-evaluation.

Disputes are debated primarily on UMA’s Discord server, where users present arguments and share evidence for their positions. These are often labeled using standard shorthand:

- P1 (NO): You disagree with the proposed outcome (Imagine reference case)

- P2 (YES): You agree with the proposed outcome (Imagine reference case)

- P3 (50/50): You believe the result should be split (rare)

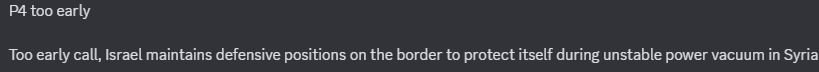

- P4 (TOO EARLY): The outcome was proposed too soon for example, during a live event or before clear evidence emerged

P4 is also used when there is insufficient evidence to resolve a market. In this case, the dispute aims to delay final resolution until clearer information is available or until the market’s official timeline ends.

Who Writes in UMA?

While voting is restricted to UMA token holders, the discussion is open to everyone and is often dominated by Polymarket users with a position in the disputed market.

These traders have a clear incentive to argue in favor of the result that benefits their position. In some cases, prominent community members or UMA admins have stepped in to share opinions, and even a single well respected voice can dramatically sway sentiment.

Who Votes?

Only holders of UMA tokens are eligible to vote. This introduces an important dynamic: the final outcome is decided not by all Polymarket users, but by a much smaller circle of token holders.

This concentration of voting power has led to criticism of centralization, especially when decisions are closely contested or involve large amounts of capital.

It’s therefore important to understand not just what people are saying but who will actually cast the deciding votes.

Why Vote?

Voters are financially rewarded for participating. UMA offers incentives to those who vote in line with the final, majority approved outcome. So it’s not just about governance it’s also an opportunity to earn.

What Happens to the Market During a Dispute?

Contrary to what some may expect, a disputed market doesn’t freeze it often becomes even more volatile.

Prices can swing wildly as new evidence is introduced or as influential users comment on Discord. A single wallet’s post or endorsement can spark a wave of buys or sells, and changes in perceived consensus often lead to price whiplash.

For many traders, this makes disputed markets as risky as they are exciting especially when large amounts are still on the line.

Possible Scenarios During a UMA Vote

When a market enters the voting phase on UMA, several outcomes are possible, each with very different consequences for traders:

- Stalemate and uncertainty:

The community is divided, with strong arguments on both sides and no clear consensus. Prices may remain volatile and sentiment split, creating a high-risk, high-stress trading environment. - Clarification from Polymarket:

In rare cases, Polymarket itself intervenes to clarify the rules or scope of a market. While unusual, this can significantly shift how voters interpret the resolution. - Market becomes a “bond”:

Sometimes, based on how UMA historically votes and the arguments being presented, traders start treating the outcome as effectively decided, with the voting seen as a formality. Prices may stabilize near 100% in one direction before the vote is even complete, best tip: look who are the holders to understand, the result 😉 - Shocking reversal:

In very rare but impactful instances, the vote surprises everyone flipping what seemed like a guaranteed result. A market that looked like a 90% YES bond may suddenly become 100% NO in a matter of minutes, causing massive liquidations and confusion.

These dynamics are part of what makes UMA governance both powerful and risky. For traders, the key is to recognize the signals early, stay informed, and never assume a result is final until the vote actually settles.

Final Thoughts on UMA Disputes: Caution is the key!

Disputed markets are some of the hardest to trade on Polymarket. They are:

- Volatile: Prices can swing on emotion, timing, or a single sentence

- Controversial: Disputes often involve intense disagreement

- Prolonged: They can drag on if multiple rounds of dispute occur

For these reasons, disputed markets are not ideal for beginners. Unless you fully understand how the UMA voting system works and who holds the power to decide, entering a market in dispute could lead to unexpected outcomes.

Because in disputed markets, knowledge is everything and sometimes, knowing when to stay out is the smartest trade of all

Disclaimer:

This article is for informational purposes only. It is not intended to discredit UMA, its governance system, or its participants. The goal is to help Polymarket users better understand how disputes and voting processes work.

For official information and detailed protocol documentation, please visit the UMA website.

-

Top 5 Most Spot-On Predictions Ever on Polymarket (That Totally Crushed the Polls!)

Top 5 Most Spot-On Predictions Ever on Polymarket ? When polls stumble, Polymarket struts in with…

-

What Is a Prediction Market? A Simple Guide to Betting on the Future

What Is a Prediction Market? A prediction market is a type of market where people can…

-

How to Trade in Polymarket: 4 Essential Steps Before Buying in a Prediction Market

How to Trade in Polymarket: 4 Essential Steps Before Buying in a Prediction Market Trading on…