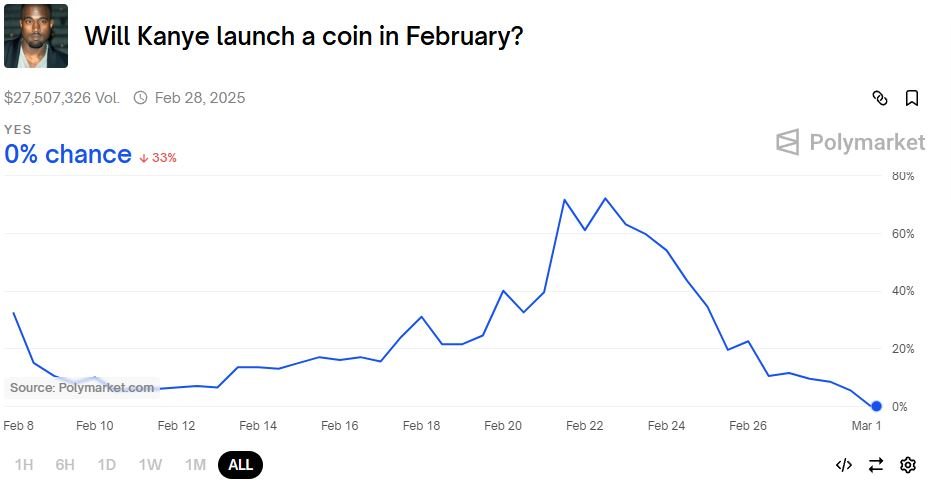

Among all the wild markets ever to unfold on Polymarket, few will be remembered quite like “Will Kanye launch a coin in February?”. It instantly became one of the most chaotic, unpredictable, and talked about markets in the platform’s history.

🎢 The Ultimate Rollercoaster

For days, Polymarket traders were caught in a whirlwind of rumors and speculation. At the center of it all was Kanye West himself, who teased the possibility of launching a token in a series of cryptic tweets. One day he hinted he was thinking about it, and by the next post he had completely backtracked.

This back-and-forth left traders scrambling to interpret every tweet, statement, and social media post as they tried to anticipate which way the market would resolve.

💣 The Insider Risk Became Real

Many believe this market marked the most obvious case of insider risk ever witnessed on Polymarket. During the frenzy, multiple fake Kanye tokens were launched, suspected to have been used to manipulate the perception of legitimacy and artificially inflate the price of YES shares.

This created what was widely regarded as a massive pump and dump scenario, with unsuspecting traders caught in the crossfire.

The crypto community, always alert to Kanye’s unpredictability, became intensely aware of this market’s existence and volatility on Polymarket.

📈 The February 22 Price Surge

One of the most dramatic moments came on February 22, just days before the market was set to close. On that day, the YES shares surged to nearly 72 cents, reflecting widespread belief that a token launch was imminent. The spike followed a series of Kanye tweets and rumors of an alleged collaboration with another high-profile crypto figure to organize the release.

However, the highly anticipated launch never materialized, crushing any remaining hope for YES holders and causing the market to collapse dramatically in the final hours. The extreme price swings and uncertainty only added to the market’s reputation as one of the most volatile and unpredictable in Polymarket history.

😱 Legendary Traders Were Shaken

The chaos didn’t spare even some of Polymarket’s most respected figures. Aenews, a veteran and high profile trader, reportedly took a significant loss on this market. Decap, another top trader, went so deep down the Kanye rabbit hole that he changed his username to KanyeTruther.

For some, though, the madness paid off. Axios, now a rising name in mention markets, made a big impact thanks to the strategy and timing they deployed during the Kanye token saga.

👀 The Shadow of Kanye Still Haunts Traders

Even today, the ghost of the Kanye token market lives on in Polymarket lore. The possibility of Kanye actually launching a token still fascinates many traders, who remain ever-ready to bet on it should the opportunity return.

After all, Polymarket traders have a reputation of embracing wild speculation. As one community member jokingly put it:

“Polymarket users are true degenerates.”

And the Kanye market stands as the perfect example of just how far traders will go to chase an edge in the world’s most unpredictable prediction markets.

Kanye launch a coin

Index

-

Infringe

Infringe is a Polymarket trader active since 2023, whose most significant success has emerged more recently. With over 30k in profits, he has established himself as a sharp and opportunistic participant, capable of moving fluidly between different categories of markets when the right moment appears.

-

Nik

Nik is a Polymarket trader active since 2024, defined by courage, mental strength and resilience. His journey has not been linear. In the beginning, he faced several losses, which he said to Polynoob were caused by an unhealthy mindset and flawed decision making. But instead of stepping away, Nik chose reflection over frustration.

-

Kii0nX

Kii0nX is a Polymarket trader active since 2024, instantly recognizable for his friendly and cheerful profile image. Polynoob truly appreciates this kind of presence, as it brings a sense of lightness and positivity to the platform. Kii0nX is still at the beginning of his journey, moving forward with calm, patience, and carefully reasoned choices as…