South Korea election 2025

The South Korean election 2025, delivered one of the most unpredictable and intense moments in Polymarket’s recent history. A combination of misleading exit polls, extreme volatility, and high pressure decisions put every trading strategy to the test splitting the community between those who panicked and those who stayed calm.

Exit Poll Shock

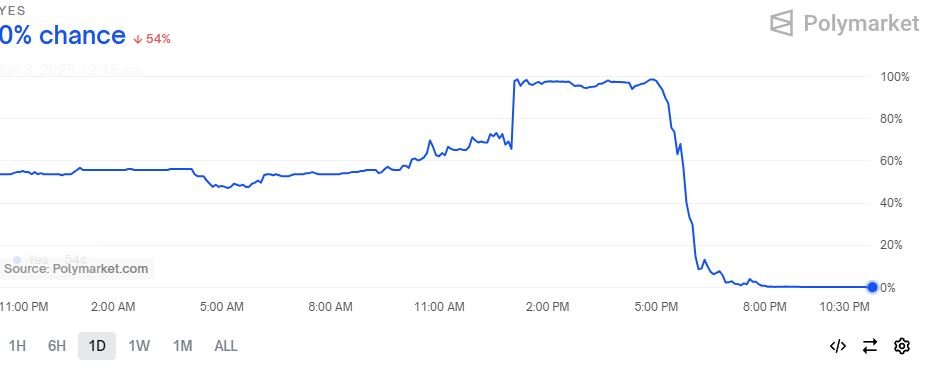

It all began with the release of the first exit polls, which showed Lee Jae-myung above 50% and Kim Moon-soo below 40%. The market’s reaction was swift and brutal: confidence in Lee surged, and prices across multiple markets flipped dramatically.

Traders were suddenly faced with a crucial decision

trust the data or rely on their instincts?

For hours, volumes spiked and prices swung wildly, as the community watched the chaos unfold in real time. Some liquidated immediately. Others held or even doubled down, believing the final count might tell a different story.

The Final Reversal

As is often the case in prediction markets, the real story came later.

Final results did confirm Lee Jae-myung’s victory, something Polymarket had been pricing in for weeks. But the margin was far smaller than the exit polls suggested, triggering a massive reversal in secondary markets, including those tied to vote share and percentage thresholds

Fortunes were made in a matter of hours

Some Big Winners: RememberAmalek and CrayonConnoisseur

Among the traders who made the most of the moment were RememberAmalek, with reported gains of over $350,000 among his alts, and CrayonConnoisseur, who nearly doubled his portfolio. These weren’t lucky guesses, they were high-stakes decisions made under pressure, and they paid off.

In a short interview with Polynoob, CrayonConnoisseur shared:

“With election markets, it is very easy to tell where the momentum is going. At one point everybody thought the market was going one way but it was going the other way and I won big. I had to place orders based on my best judgment and hope my thinking was correct.”

His words highlight a key truth in prediction markets: sometimes, it all comes down to self-confidence. When the noise gets loud and the charts start to blur, trusting your reasoning can make all the difference.

But just as some won big, others took heavy losses. For every trader who timed the flip perfectly, there were many who trusted the early data, sold too late, or misread the momentum. And while Polymarket is, at its core, a PVP (player vs player) platform, it’s important to remember that behind every trade is a person.

Respect who lost

Victory and defeat are two sides of the same market, and what defines the community is how we learn from both. Every election brings risk and every outcome, whether profitable or painful, is part of the game. But we are still human, and mutual respect should always remain part of the culture.

On Polymarket, success doesn’t belong to those who follow the crowd, but to those who can read between the lines and act decisively. The South Korean election proved that once again.

-

The First US Shutdown of 2026 on Polymarket?

Less than four months ago, Polymarket traders were busy forecasting the end of one of the…

-

Portugal Presidential Election 2026 on Polymarket

On the western edge of Europe, on the Iberian Peninsula, Portugal is preparing for a highly…

-

The US-Venezuela crisis on Polymarket

In the Caribbean Sea, for months now, Polymarket traders have been grappling with a scenario as…