Will the United States strike Iran before July?

The Polymarket market “US military action against Iran before July?” is quickly becoming one of the most intense geopolitical markets of the year and traders are flooding in.

Tensions Rise and So Do the Bets

With rumors of imminent action and real-world deployments escalating, the market has seen massive positions from both sides.

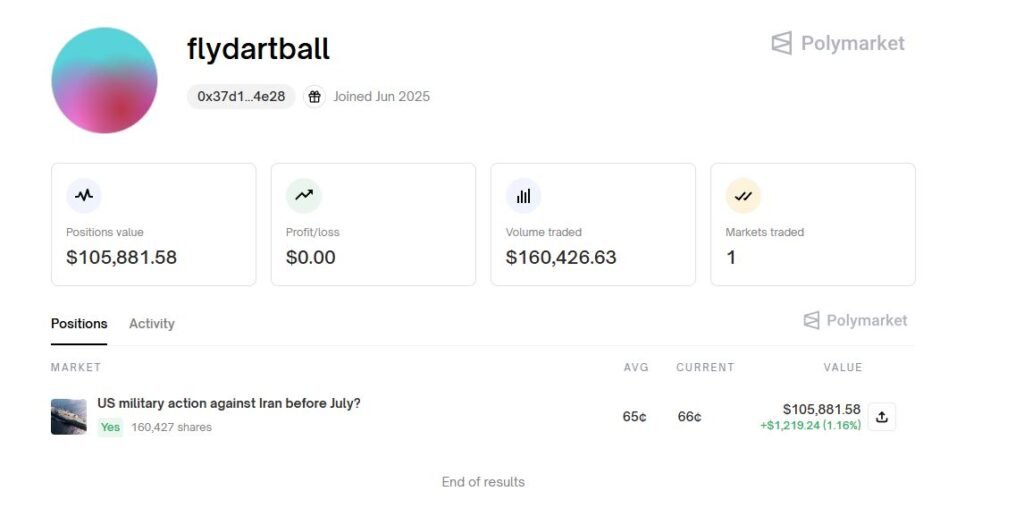

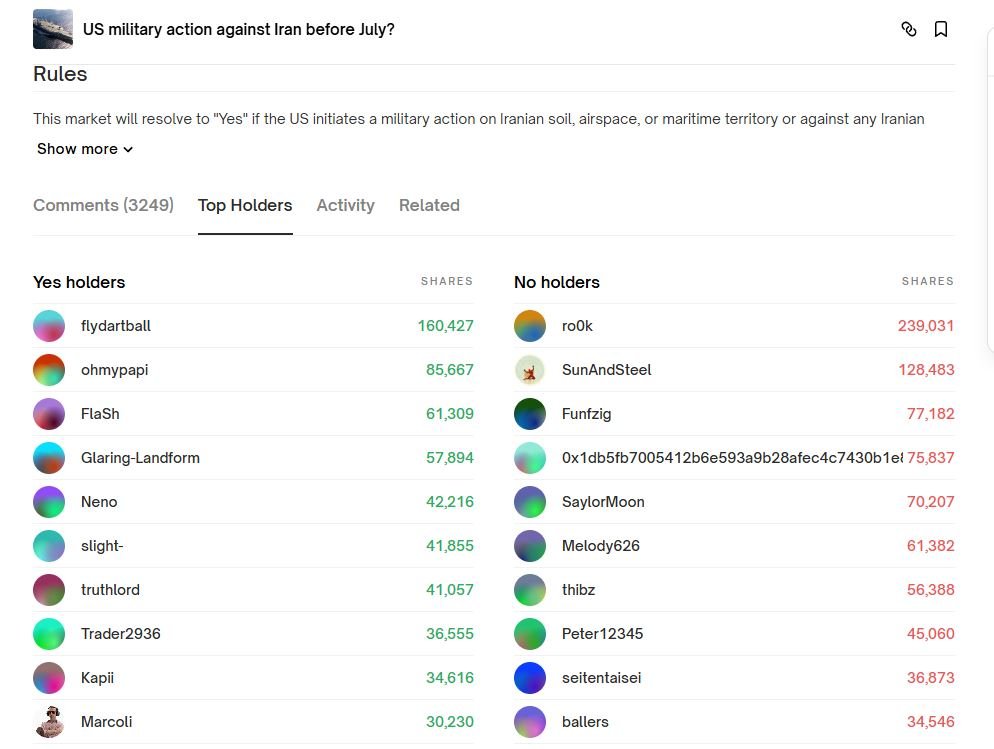

New wallet flydartball dropped at 17/06/2025, in with over $105,000 on Yes, making them the #1 holder with 160,427 shares. Other names like ohmypapi, FlaSh, and Glaring-Landform have added serious weight behind a potential strike.

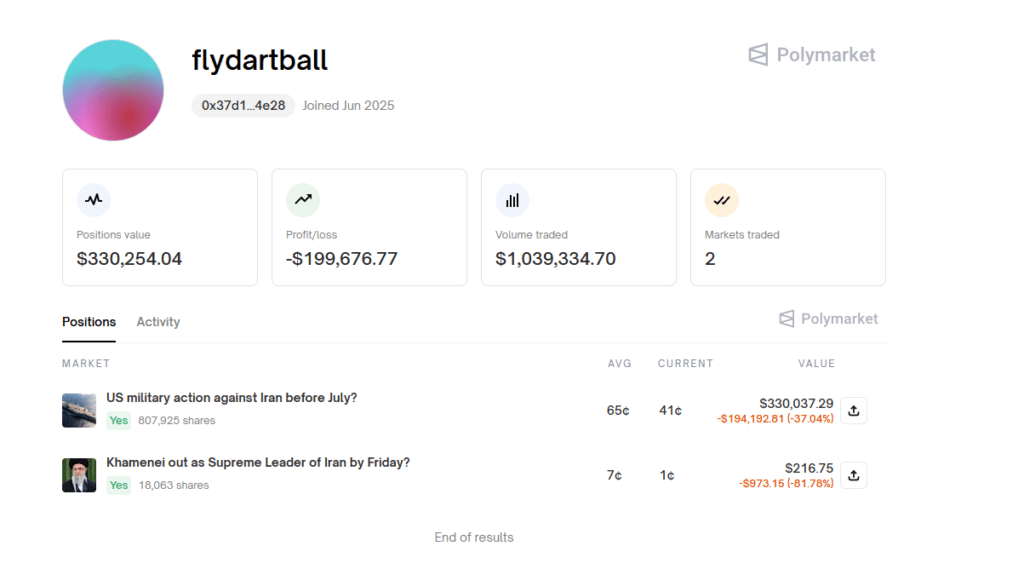

Now he has more of 800k share

Meanwhile, skeptics are positioning just as aggressively.

On the No side, ro0k leads with 239,031 shares, followed by SunAndSteel, Funfzig, and others placing six-figure volume bets that the US will hold off

🛰️ Real-World Escalation

This isn’t just a market it’s mirroring headlines:

- US and UK warships are reportedly approaching Iranian waters

- Bomber aircraft are confirmed to be stationed at Garcia base

- Trump is holding high level War Room meetings

- Diplomatic communications remain tense and limited

With the July deadline approaching and headlines intensifying by the hour, this market has become a high-stakes pulse check on global risk.

The Trader’s Dilemma: Trust the News or the Noise?

At this moment, Polymarket traders are facing a crucial choice:

Do they trust alleged insiders pushing whispers of military action? Or rely on their own judgment, macro reading, and data analysis?

The line between signal and noise has never been thinner and the stakes never higher.

Both choices come with risk. One may offer edge. The other, pure speculation.

Either way, it’s a decision that separates strategy from gamble and reveals what kind of trader you really are.

Final Thoughts on US-Iran war Market on Polymarket Why It Matters !

ediction markets thrive in uncertainty and this one is overflowing with it.

The US-Iran military market is no longer just a bet; it’s a monster of information, emotion, and global consequence.

The combination of breaking news, fleet movements, bomber deployments, and massive bets has turned this into a true case study in real time geopolitical speculation. It’s not just about who’s right, it’s about who reads the moment correctly, under pressure, with real money on the line.

No matter how it ends, this event will stay in the minds of Polymarket traders for a long time.

It’s a test of logic, instinct, and resilience and of course, we all hope the real-world outcome leans toward stability, not escalation.

Stay sharp, follow the traders, and don’t miss the next move.

Because on Polymarket, you’re not just watching history you’re betting on it

-

The First US Shutdown of 2026 on Polymarket?

Less than four months ago, Polymarket traders were busy forecasting the end of one of the…

-

Portugal Presidential Election 2026 on Polymarket

On the western edge of Europe, on the Iberian Peninsula, Portugal is preparing for a highly…

-

The US-Venezuela crisis on Polymarket

In the Caribbean Sea, for months now, Polymarket traders have been grappling with a scenario as…