Disclaimer: The following strategy is not real financial advice and is purely a meme strategy. This content is for educational and entertainment purposes only.

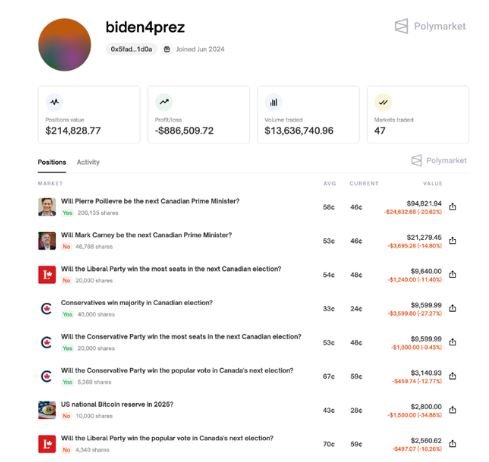

“Do the opposite” is more than just a funny meme, it’s become a genuine trading strategy based on the premise that certain traders are somehow cursed or incredibly unlucky in their actions. The concept is simple: the moment you see them buy YES, you should buy NO. Conversely, when they buy NO, you buy YES. It’s a complete inverse alpha signal, whatever side they take, you take the opposite.

Obviously there is no real constant correlation, in fact often the unlucky traders analyzed, have only had bad luck, in a bet 🙂

Origins: Do The Opposite!

It all started as a simple meme linked to Polymarket traders, they began noticing that when certain users made purchases, the exact opposite would happen; the pattern became so noticeable and entertaining that it evolved from an inside joke into a semi serious trading consideration.

This meme strategy became so popular that even Polymarket itself began spreading it obviously joking (well, not always, but some traders noted a remarkable pattern). What began as lighthearted ribbing of unlucky traders transformed into a cultural phenomenon within the prediction markets community.

The Psychology Behind the Pattern

Why does this pattern seem to emerge? Several factors contribute:

Emotional Trading: Cursed traders often buy at emotional peaks, when news feels most compelling but prices are most inflated.

Contrarian Indicator: By the time the unluckiest traders notice a trend, the smart money has often already positioned for the reversal.

Confirmation Bias: Once a trader gains a reputation for being “cursed,” the community watches them more closely

FOMO Timing: Unlucky traders frequently enter positions at the worst possible moment, right before reversals creating a reliable inverse signal

Critical Warnings and Considerations

These are some points that must be considered when applying this crazy strategy, first of all:

- The Cursed Trader Can Still Win :): Just because someone has been unlucky doesn’t mean they’re always wrong, so never bet your entire bankroll on the opposite strategy alone ( DON’T DO THAT)

- Think Independently: Don’t rely solely on this approach. Always conduct your own analysis and reasoning. The “opposite” strategy should be one factor among many in your decision-making process, not the only factor.

- Diversification Is Always Key: Never put all your capital into inverse positions based on one trader’s moves. Spread your risk across multiple strategies, markets, and timeframes. This strategy works best as part of a diversified portfolio approach.

- Pattern Degradation: Once a trader becomes known as cursed, they may change their behavior or even start fading themselves, breaking the curse you’ve been exploiting.

- Ethical Considerations: Remember there’s a real person behind every trader account. While the meme is funny, AVOID harassment or mockery

Conclusion about: do The Opposite! the meme Strategy on Polymarket

“Do the opposite” represents the playful, experimental spirit of prediction markets. What started as a meme has become a semi legitimate trading consideration, demonstrating how community observation can identify genuine patterns in market behavior and in a trader mind

However, it remains crucial to remember, think independently, diversify always, and maintain respect for the human beings behind every position, even the ones who seem perpetually unlucky, because remember, everything can change in an instant

The beauty of prediction markets lies in their ability to aggregate diverse perspectives. Sometimes, the most valuable perspective is knowing exactly which one to fade. But even cursed traders occasionally break their streak, so trade the opposite with wisdom, humility, and always with a plan

Are you a cursed trader?

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Trading on prediction markets involves risk, and past performance does not guarantee future results. Always do your own research and trade responsibly.

-

Arbitrage on Prediction Market

In the world of prediction markets, where people bet on real-world events—from elections to sports to…

-

Scam Tactics in Prediction Markets: Beware of Manipulative Comments on Polymarket and Kalshi

Scam Tactics in Prediction Markets:In the fast-growing world of prediction markets like Polymarket and Kalshi, Introduction:…

-

Nothing Ever Happens a meme Strategy?

“Nothing Ever Happens” isn’t just a meme for many Polymarket users betting on the fact that…