Disclaimer: The following strategy is not real financial advice and is purely a meme strategy. This content is for educational and entertainment purposes only.

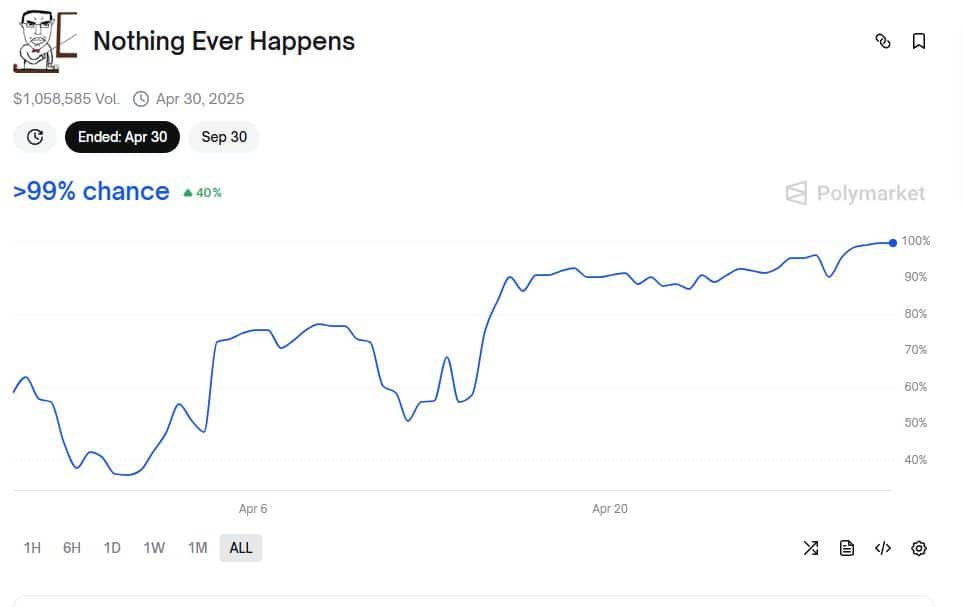

“Nothing Ever Happens” isn’t just a meme for many Polymarket users betting on the fact that nothing ever really happens has often proven to be a winning model. Obviously, sometimes things do happen, but thinking that nothing new will occur can be a profitable strategy when applied correctly.

The Origins of the Strategy

It all started when many Polymarket users began writing on social media and in Polymarket comments “Nothing Ever Happens” in relation to any important event, such as “Russia x Ukraine ceasefire” or “Will Russia control Chasiv Yar on May 9?” This phrase became a rallying cry for traders who observed a pattern in how major events often fail to materialize within the specific timeframes that prediction markets demand.

The meme became so popular that Polymarket itself embraced it, launching several markets directly based on the concept. Markets like “Nothing Ever Happens: September“ and “Nothing Ever Happens: MrBeast Edition“ appeared on the platform, turning the community joke into actual trading opportunities. This demonstrates the great strength of prediction markets and Polymarket, where the community plays a leading role in creating and proposing new markets.

The strategy emerged from a crucial insight about human nature and political reality: most significant geopolitical, diplomatic, or social changes happen much more slowly than market deadlines suggest. Traders began to notice that while dramatic headlines might suggest imminent breakthroughs or catastrophes, the actual machinery of change, bureaucracy, negotiations, logistics, and human psychology, often moves at a glacial pace compared to the urgent timelines that drive market speculation.

The “Nothing Ever Happens” mentality reflects a deeper understanding of how the world actually works versus how exciting it appears in news cycles and social media. While journalists and politicians have incentives to dramatize potential changes and create urgency around developing situations, the reality is that meaningful change often requires extended periods of preparation, negotiation, and implementation that extend well beyond typical market resolution dates.

Why It Often Works

The strategy succeeds because prediction markets, by their very nature, must set specific deadlines for resolution. These deadlines create artificial urgency around events that in reality might unfold over months or years rather than weeks. Diplomatic breakthroughs, military victories, political reforms, and social movements typically require more time to develop than the market timeline allows.

Consider geopolitical events like ceasefires, territorial captures, or diplomatic meetings. While these might seem imminent based on news reporting, the actual negotiations, logistics, and political considerations often extend far beyond market deadlines. Military operations face weather, supply chain issues, and strategic complications. Diplomatic negotiations encounter unexpected obstacles, require multiple rounds of talks, and depend on political calendars that don’t align with prediction market timelines.

Furthermore, there’s often a bias toward optimism in market pricing for positive outcomes like peace deals or diplomatic breakthroughs. People want to believe that conflicts will end quickly and that reasonable solutions will emerge rapidly. This creates opportunities for “Nothing Ever Happens” traders to bet against these optimistic timelines while still acknowledging that positive outcomes might eventually occur just not within the market’s specific timeframe.

The Risks and Limitations

However, this isn’t always the case, and many traders have discovered this bitterly by blindly betting on this seemingly meme strategy.

Sometimes things do happen, and they happen quickly. Military situations can change rapidly due to unexpected tactical developments. Political crises can reach sudden resolution points. Natural disasters, technological breakthroughs, or surprise announcements can dramatically alter expected timelines. Traders who apply the “Nothing Ever Happens” strategy without considering the specific circumstances of each market can face devastating losses.

Strategic Guidelines for “Nothing Ever Happens” Trading

Here are a few tips on this crazy strategy:

- Always Diversify: Never put all your capital behind the assumption that nothing will happen in a single market.

- Consider Why Such an Event Might Not Happen Within the Deadline: Ask yourself specific questions about the mechanisms that would need to align for the event to occur. Are there bureaucratic processes that typically take longer than the deadline allows? Do the key decision-makers have conflicting incentives? Are there logistical challenges that aren’t reflected in the current market optimism?

- Evaluate the Risk-Return Profile of the Operation: Calculate whether the potential returns justify the risk you’re taking. Sometimes “Nothing Ever Happens” positions offer poor risk-adjusted returns because the market has already priced

- Study Historical Patterns: Look at how similar events have played out in the past. Have ceasefire negotiations in this region typically moved quickly or slowly? Do diplomatic meetings of this type usually produce immediate results? Historical context can inform whether “Nothing Ever Happens” is likely to apply to a specific situation.

When to Avoid This Strategy

The “Nothing Ever Happens” strategy can be a valuable tool in a prediction market trader’s arsenal, but like any approach, it requires careful application rather than blind faith. When used thoughtfully, with proper risk management and realistic assessment of specific market conditions, it can exploit the common human bias toward expecting dramatic change on unrealistic timelines.

“Nothing ever happens, but when it does, don’t be surprised.”

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Trading on prediction markets involves risk, and past performance does not guarantee future results. Always do your own research and trade responsibly.

-

Do The Opposite! The Meme Strategy on Polymarket

“Do the opposite” is more than just a funny meme, it’s become a genuine trading strategy…

-

Polymarket’s liquidity rewards

One of the key innovations that helps Polymarket function smoothly is its Liquidity Rewards Program a…

-

Nothing Ever Happens a meme Strategy?

“Nothing Ever Happens” isn’t just a meme for many Polymarket users betting on the fact that…